www.aljazeerah.info

News, December 2014

Archives

Mission & Name

Conflict Terminology

Editorials

Gaza Holocaust

Gulf War

Isdood

Islam

News

News Photos

Opinion Editorials

US Foreign Policy (Dr. El-Najjar's Articles)

www.aljazeerah.info

|

Editorial Note: The following news reports are summaries from original sources. They may also include corrections of Arabic names and political terminology. Comments are in parentheses. |

Russian Rouble Suffers Steepest Drop in 16 years, Despite Raising Interest Rates in an Emergency Move

December 16, 2014

|

|

Russian rouble suffers steepest drop in 16 years

By Alexander Winning and Vladimir Abramov

MOSCOW Tue Dec 16, 2014 12:14pm EST

(Reuters) -

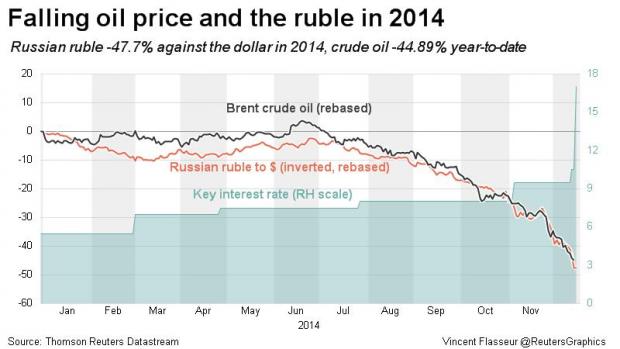

The rouble plunged more than 11 percent against the dollar on Tuesday in its steepest intraday fall since the Russian financial crisis in 1998 as confidence in the central bank evaporated after an ineffectual rate hike.

The rouble opened around 10 percent stronger against the dollar after the central bank unexpectedly raised its benchmark interest rate by a hefty 650 basis points to try and halt the currency's slide, but it reversed gains in volatile trade and repeatedly set new record lows.

It has now fallen close to 20 percent this week, taking its losses this year against the dollar to over 50 percent and raising memories of the crisis in 1998 when the currency collapsed within a matter of days, forcing Russia to default on its debt.

Although Russia's public finances and reserves are much healthier than in 1998, analysts say the country is on the brink of a full-blown currency crisis.

At 1435 GMT, the rouble was down around 11 percent against the dollar at 72.44 after earlier racing past 80 roubles per dollar for the first time to be down around 20 percent at one stage from the previous close.

Against the euro, it was almost 13 percent weaker at 90.50.

The rouble has been hit by the slump in oil prices and Western sanctions imposed over Russia's involvement in Ukraine, but its sharp decline over the past two days also reflects declining confidence in the central bank.

The 650-basis-point rate hike, less than a week after another 100-basis-point rise, was seen as a sign of desperation by the bank, whose Governor Elvira Nabiullina now appears powerless to stop the currency's slide, raising the risk of capital controls.

The market ignored Nabiullina's comments on Tuesday that the rouble was undervalued.

"If such an interest rate rise didn't impress the market, then they (the central bank) have left the option of interventions of $10 billion a day. They are in (the market) every day," said Natalia Orlova, chief economist at Alfa Bank.

Investors were also unnerved by the prospect that Russian oil major Rosneft, which recently issued 625 billion roubles ($8.67 billion) in bonds, could convert the funds into foreign currency, adding further pressure on the rouble.

Rosneft has said the money will not be used to buy foreign currency.

Russia's dollar-denominated RTS share index was down as much as 19 percent at one point, extending heavy losses from Monday, and shares in top bank Sberbank - seen as a barometer for the wider economy - plunged over 20 percent.

Russian sovereign dollar bonds fell and money market rates jumped.

President Vladimir Putin has blamed both the slide in oil and the rouble on speculators and the West. A weak rouble poses a major test for Putin, since his popularity in part depends on his reputation for guaranteeing prosperity and stability, and it stokes inflation.

"The central bank will have a very hard time stabilising the rouble as long as the sharp sell-off in oil prices continues," Vladimir Miklashevsky, an economist at Danske Bank, said in a note.

Brent crude prices fell below $60 on Tuesday for the first time since July 2009, hurting the outlook for Russia's oil-dependent economy, which the central bank says is likely to contract early next year.

The central bank has spent over $80 billion defending the rouble this year, including more than $8 billion since it floated the currency in November.

The country still has ample reserves of around $416 billion but analysts say the currency is in dangerous territory as it is increasingly being driven down by sheer panic.

"What now rules the Russian currency is not oil, or even waiting for it to move, but panic fuelled by a large number of rumours about the return of our country to the "98-year" regime," said Alena Afanasyeva, a senior analyst at Forex Club in Moscow.

($1 = 72.0620 roubles)

(Reporting by Lidia Kelly, Vladimir Abramov, Alexander Winning, Katya Golubkova and Elena Fabrichnaya; Editing by Elizabeth Piper and Susan Fenton)

Russia raises rates in emergency move as ruble collapses

MOSCOW Tue Dec 16, 2014 12:38pm EST

(Reuters) -

Russia's central bank raised its key interest rate to 17 percent from 10.5 percent early Tuesday in an emergency move to halt a collapse in the rouble as oil prices decline and the country's sanctions-hit economy slides toward recession.

The ruble RUB= RUB=EBS strengthened sharply after the decision, recouping some of its heavy losses on Monday, when the currency staged its largest one-day fall since 1998.

Russia has raised the key rate RUCBIR=ECI a total of 11.5 percentage points this year amid market turmoil linked to the Ukraine crisis, and such a high rate will likely further choke economic growth.

"This decision is aimed at limiting substantially increased ruble depreciation risks and inflation risks," the central bank said in a statement.

The outlook for Russia's economy has darkened considerably since the summer as capital flight has soared due to broad-based risk aversion to Russian assets and sanctions restricting Russian companies' access to international capital markets.

That poses a major challenge for President Vladimir Putin, whose popularity, based partly on providing stability and prosperity, is at risk from the ruble's decline, which is damaging Russia's credibility among investors.

The central bank early on Tuesday also increased the maximum volume of foreign currency it provides to Russian banks via its foreign-exchange repurchase agreement auctions for 28 days to $5 billion from $1.5 billion.

It said that in order to strengthen the efficiency of monetary policy, loans secured by non-marketable assets or guarantees for two to 549 days would be provided at a floating interest rate.

The central bank now says the economy is likely to contract in annual terms early next year and that it could shrink by around 4.5 percent in 2015 as a whole if oil prices average $60 a barrel.

Russia's economy still depends in large measure on sales of oil and gas, which account for about two-thirds of exports, despite liberal policymakers calling for structural economic reform for years.

That means swings in global oil prices have a significant impact on Russia's balance of payments, and therefore the rouble exchange rate.

Former Finance Minister Alexei Kudrin wrote on Twitter on Tuesday that the ruble's slide was also due to a lack of trust in the Russian government's economic policies.

Investors took Tuesday's rate hike as positive, saying it showed the central bank's defence of the currency had teeth.

"This is definitely a step in the right direction. The real interest rate right now is significantly positive, 7 to 8 percent," said Jorge Mariscal, chief investment officer for emerging markets at UBS Wealth Management in New York.

"This should make it more difficult to short (the rouble). I think it shows they are really concerned about the speed of the decline in the rouble."

(Reporting by Katya Golubkova and Alexander Winning in Moscow, Daniel Bases in New York and Cecile Lefort in Sydney; Editing by Leslie Adler, Toni Reinhold and Lisa Shumaker)

***

Share this article with your facebook friendsFair Use Notice

This site contains copyrighted material the

use of which has not always been specifically authorized by the copyright

owner. We are making such material available in our efforts to advance

understanding of environmental, political, human rights, economic,

democracy, scientific, and social justice issues, etc. We believe this

constitutes a 'fair use' of any such copyrighted material as provided for

in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C.

Section 107, the material on this site is

distributed without profit to those

who have expressed a prior interest in receiving the included information

for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml.

If you wish to use copyrighted material from this site for purposes of

your own that go beyond 'fair use', you must obtain permission from the

copyright owner.

|

|

|

|

||

|

||||||