www.aljazeerah.info

News, January 2021

Archives

Mission & Name

Conflict Terminology

Editorials

Gaza Holocaust

Gulf War

Isdood

Islam

News

News Photos

Opinion Editorials

US Foreign Policy (Dr. El-Najjar's Articles)

www.aljazeerah.info

|

Editorial Note: The following news reports are summaries from original sources. They may also include corrections of Arabic names and political terminology. Comments are in parentheses. |

Volatile Bitcoin Prices Trading in Mid-$30,000s, Janet Yellen Promises Effective Crypto Regulation,

January 25, 2021

|

|

| Janet Yellen |

Janet Yellen Clarifies Her Stance on Bitcoin, Promises Effective Crypto Regulation

Joe Biden’s pick to become the new U.S. Treasury Secretary, Janet Yellen, has clarified her stance on bitcoin and cryptocurrencies. This follows her remarks during a Senate hearing when she said that cryptocurrencies are mostly used for illicit financing.

Janet Yellen clarified her position on the regulation of cryptocurrencies in a written testimony published Thursday following the Senate hearing on her nomination as the Treasury Secretary. During the hearing, Yellen made some statements regarding cryptocurrencies which were heavily criticized as being inaccurate.

The finance committee began by briefly describing the benefits and risks of bitcoin and other cryptocurrencies. “Bitcoin and other digital and cryptocurrencies are providing financial transactions around the globe, like many technological developments, this offers potential benefits for the U.S., and our allies,” the written testimony reads. “At the same time, it also presents opportunities for states and non-state actors looking to circumvent the current financial system and undermine American interests. For example, the Central Bank of China just issued its first digital currency.”

“Dr. Yellen, what do you view as the potential threats and benefits these innovations and technologies will have on U.S. national security? Do you think more needs to be done to ensure we have appropriate safeguards and regulations for digital and cryptocurrencies in place?” the finance committee asked the Treasury Secretary nominee.

Yellen replied: “I think it important we consider the benefits of cryptocurrencies and other digital assets, and the potential they have to improve the efficiency of the financial system.”

She continued, “At the same time, we know they can be used to finance terrorism, facilitate money laundering, and support malign activities that threaten U.S. national security interests and the integrity of the U.S. and international financial systems,” elaborating:

I think we need to look closely at how to encourage their use for legitimate activities while curtailing their use for malign and illegal activities.

“If confirmed, I intend to work closely with the Federal Reserve Board and the other federal banking and securities regulators on how to implement an effective regulatory framework for these and other fintech innovations,” Yellen concluded.

Yellen’s clarification marginally softens her stance on cryptocurrency, contrasting her previous statements made during her confirmation Senate hearing. “Cryptocurrencies are a particular concern. I think many are used … mainly for illicit financing and I think we really need to examine ways in which we can curtail their use and make sure that anti-money laundering (sic) doesn’t occur through those channels,” Yellen said a few days prior.

Last week, the president of the European Central Bank (ECB), Christian Lagarde, also made a statement about bitcoin that drew much criticism. She said bitcoin “has conducted some funny business and some interesting and totally reprehensible money laundering activity.” Many were also quick to point out how wrong Lagarde was, including a famed economist who said her statement was “outrageous.” He stressed that “we all know that the vast majority of money laundering globally is conducted in fiat currencies, particularly in U.S. dollars and euros.”

***

Cryptocurrencies: Bitcoin Return to $40,000 in Doubt as Flows to Key Fund Slow

By Eric Lam

Blookberg, January 24, 2021, 10:06 PM EST Updated on January 25, 2021, 5:38 AM EST

JPMorgan strategists flag risk of unwinding in Bitcoin futures Bitcoin prices have been volatile, trading in the mid-$30,000s

Cryptocurrency enthusiasts counting on Bitcoin to bounce back above the $40,000 level face a challenge due to faltering demand for the biggest fund tracking the digital asset, according to JPMorgan Chase & Co.

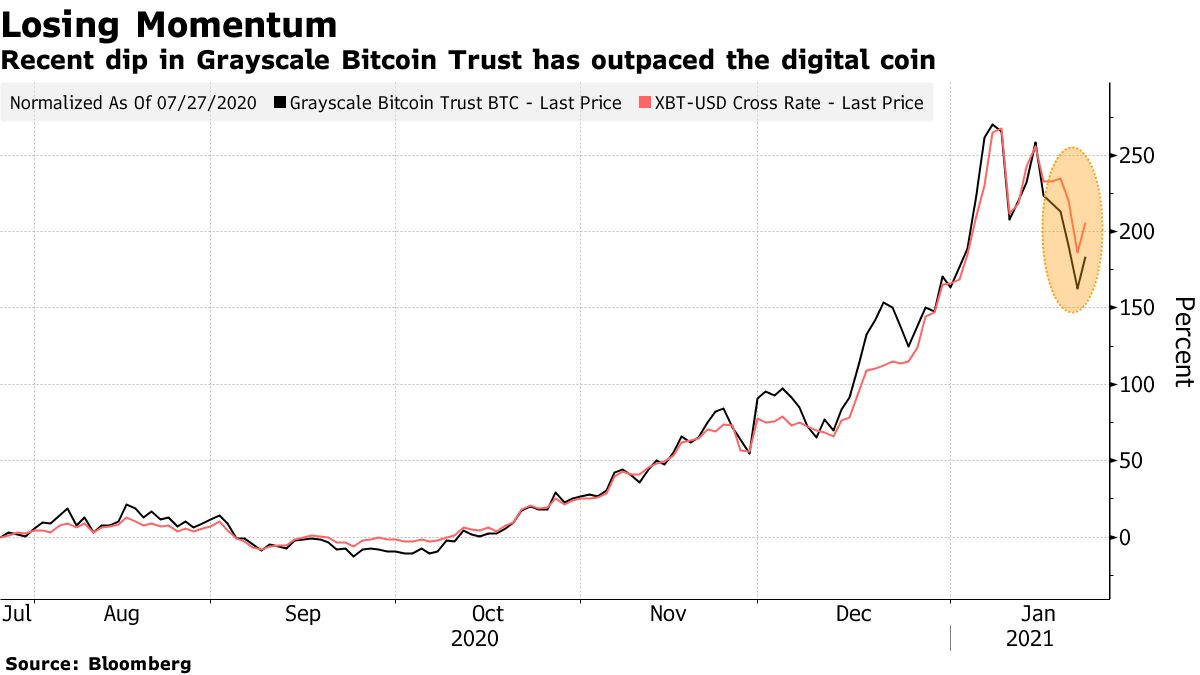

The pace of flows into the $20 billion Grayscale Bitcoin Trust “appears to have peaked” based on four-week rolling averages, JPMorgan strategists led by Nikolaos Panigirtzoglou said in a note Friday. The fund slid 22% over the past two weeks through Jan. 22, outpacing a 17% drop in Bitcoin in the same period.

“At the moment, the institutional flow impulse behind the Grayscale Bitcoin Trust is not strong enough for Bitcoin to break out above $40,000,” the strategists said. They added that the “risk is that momentum traders will continue to unwind Bitcoin futures positions.”

Bitcoin’s red-hot rally lost momentum after the largest cryptocurrency reached a peak of almost $42,000 on Jan. 8. Proponents argue institutional interest has helped bolster Bitcoin’s use as a hedge against dollar weakness and inflation, while skeptics maintain the latest surge is yet another speculative bubble, akin to the 2017 mania that preceded a rapid collapse.

In recent days, prices have been volatile in the mid-$30,000s and the digital coin is still sitting on a gain of almost 270% over the past year. On Monday, Bitcoin advanced about 4% to $33,078 as of 10:35 a.m. in London.

“The near-term balance of risks is still skewed to the downside,” the JPMorgan strategists said.

In a separate analysis, Adam James with OKEx Insights found at least some long-term Bitcoin holders -- so-called “whales” -- and miners likely sold to institutional investors during the 2020 rally, as the average age of coins traded rose starting in October and has remained elevated since.

“Old-school Bitcoiners sold some of their old bags to new institutional buyers with extremely large new bags to fill,” James wrote. OKEx Insights is affiliated with crypto exchange OKEx.

Bitcoin (BTC USD) Cryptocurrency Price Rise $40,000 in Doubt - Bloomberg

***

Bitcoin Exchanges from Chile, Mexico and Argentina Will Have Brazilian Competition

Brazilian cryptocurrency exchange Mercado Bitcoin currently supports some 2.2 million operators. It will also develop an insurance platform and a cryptocurrency wallet.

By The Rio Times Staff - January 25, 2021

RIO DE JANEIRO, BRAZIL -

The Brazilian cryptocurrency exchange Mercado Bitcoin announced on January 21 that it is preparing an expansion in Latin America that targets the markets of Chile, Mexico and Argentina. Operations in these countries could begin in 2021 after attracting investments of about US$37 (R$200) million.

The exchange house highlighted that the regulatory culture in these three nations is similar to that of Brazil, so it would only be a matter of time before starting activities. The intention of Mercado Bitcoin is to develop a local ecosystem like the one that exists in the United States . . .

***

Bitcoin System Review 2020 – Is it a Scam? Truth Revealed

AP News, May 20, 2020

The market for crypto robots and cryptocurrency is booming. Bitcoin System is also a provider of automated trading on the Bitcoin market. The risks of investing in digital currencies are very high, but in times of low interest rates over many years, investors have little choice if they want to at least generate a return to offset inflation.

Time and again you read reports in which investors were able to make thousands of euros in a few days with the help of cryptocurrencies. Investors who have saved for years with fixed-interest savings or savings books will probably shed tears in the eyes of such stories. However, it often happens that investors lose everything and their entire savings disappear in digital nirvana.

Choosing the right trading robot is really not easy. There are many options available and some of them can be quite confusing. We looked at the opportunities and risks that crypto bots offer, especially the Bitcoin System.

With the Bitcoin System software, you can trade with Bitcoin (BTC) automatically, because the robot actually does most of the work. The paid Capital is invested in BTC and should generate the highest possible profit. In addition to cryptocurrencies, the user can also trade with stocks, raw materials, CFDs or Forex (i.e. on the foreign exchange market).

The Bitcoin System acts as a trader and places its options according to the market situation. The algorithm evaluates price trends, statistics and the market in order to choose the best time to buy or sell. But even a computer system is only as good as the person who created it. Errors are possible, moreover, they are difficult to process a constant negative development, so that the function and mode of operation should also be checked or the automatic mode must be paused if only losses are incurred.

Is the Bitcoin System platform trustworthy?

The demand for crypto robots is growing. According to the provider, around 400,000 people are already using the Bitcoin System crypto bot, and a total investment which already exceeds 5 Billion euros.

These are impressive numbers and would also speak for the seriousness of the platform. Unfortunately, this information cannot be checked. In addition, the website does not look very professional, but looks like a start-up. The advertising is exaggerated and very one-sided, and neither an imprint, risk information nor customer service can be found.

These are now standard, at least for licensed providers. In various tests, profits were made with the help of the bot, but far from millions. This is also quite normal and nobody should seriously expect to become a millionaire on the side. But the demo version is really good. In this way, users can get to know the robot and how it works in advance, as well as the processes involved in crypto trading.

The reports on the platform are quite different. Whereby those on the page themselves only show positive experiences. Sure, after all, you want to win new customers. Certainly some investors are also disappointed if the robot does not bring the desired or hoped-for profits.

It is sometimes difficult to distinguish between users who are really cheated and only disappointed with the results. Although there are definitely black sheep among the providers who do not offer any real crypto bots, but only collect funds without any performance. Bitcoin Systems algorithm seems to work, at least. But here too the risk remains that the program will generate losses. The lower the expectations, the less you can be disappointed. And the more carefully you start and the smaller the amount invested, the less you can lose.

At the beginning, we recommend only the minimum sum of EUR 250 as an investment, where a loss may still have to be absorbed.

First of all, users should always test the functionality of the robot and platform first. There is also a demo version available, which is really practical. This allows you to test the functionality of the platform and see how the algorithm worked without any financial risk. However, it should be noted that the demo videos often work with very positive examples and make the crypto trade palatable to the user.

So do not rely on the results shown, but rather use the function to get to know the processes. If you are ready for real trading, you have to make some settings, e.g. up to what amount the robot should trade or when it should get out. And then it can actually start, the crypto bot does everything else.

Advantages of using Bitcoin System

The advantages of an automated trading program are clear: Robots have knowledge of the market, meaning that specialist knowledge is actually not necessary for investors Works continuously and around the clock Does not cost anything Makes decisions based on data and analysis, without emotions Also gives beginners access to the market Certain settings and parameters can be defined individually, e.g. a loss or profit limit.

Although the algorithm works in a very sophisticated way, no profits are guaranteed. The program does a lot of things but is not responsible for losses.

The user also determines the settings and the start of trading and therefore has an influence on the success or failure of the program. Bitcoin Systems cryptotrader is fairly easy to use and offers an easy entry into the world of trading, even without any experience.

Is there a Bitcoin System app for mobile?

There doesnt seem to be a bitcoin system mobile app available. We checked both google and iOS stores. The website, however, works fully with a mobile version.

Protection against theft and exchange rate risks

Be aware that crypto trading is highly risky. As an example, the price plummeted from $ 20,000 to $ 11,000 in a matter of days earlier this year. The platforms and exchanges are also exposed to hacker attacks. Protect your computer and digital wallet in the best possible way. The Bitcoin system seems to be a piece of legit software that really works to do as it is intended: earn as much profit as possible from trading on the crypto market for its users.

Bitcoin System Review 2020 – Is it a Scam? Truth Revealed (apnews.com)

***

Share the link of this article with your facebook friendsFair Use Notice

This site contains copyrighted material the

use of which has not always been specifically authorized by the copyright

owner. We are making such material available in our efforts to advance

understanding of environmental, political, human rights, economic,

democracy, scientific, and social justice issues, etc. We believe this

constitutes a 'fair use' of any such copyrighted material as provided for

in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C.

Section 107, the material on this site is

distributed without profit to those

who have expressed a prior interest in receiving the included information

for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml.

If you wish to use copyrighted material from this site for purposes of

your own that go beyond 'fair use', you must obtain permission from the

copyright owner.

|

|

|

|

||

|

||||||