www.aljazeerah.info

Opinion Editorials, May 2019

Archives

Mission & Name

Conflict Terminology

Editorials

Gaza Holocaust

Gulf War

Isdood

Islam

News

News Photos

Opinion Editorials

US Foreign Policy (Dr. El-Najjar's Articles)

www.aljazeerah.info

Bearish EIA Report Warns Energy Markets But Keeps Oil Prices Down By Irina Slav and Nick Cunningham Oil Price, Al-Jazeerah, CCUN, May 15, 2019 |

|

|

|

Bearish EIA Report Keeps Oil Prices Down

By Irina Slav -

Oil Price, May 15, 2019

The Energy Information Administration reported a crude oil inventory build of 5.4 million barrels for the week to May 10. This follows a 4-million-barrel draw a week earlier.

Analysts expected an inventory increase of about 3 million barrels for the week to May 10, while the American Petroleum Institute estimated inventories had risen by 8.6 million barrels.

In gasoline, the EIA reported a draw of 1.1 million barrels, versus a decline of 600,000 bpd a week earlier, with production at 9.9 million bpd. This compares with 10.1 million bpd in average daily production for the first week of May.

In distillate fuel, the authority estimated an inventory rise of 100,000 barrels for the week ending May 10, compared with a draw of 200,000 barrels a week earlier. Distillate fuel production last week averaged 5.3 million bpd, up from 5.1 million bpd a week earlier.

Oil prices have been relatively stable these past few days as tailwinds and headwinds collide, keeping prices very much in one place.

On the one hand, there is the growing tension in the Middle East following the reported sabotage on four vessels at the Emirati port of Fujairah, which early U.S. assessment said may be the result of Iranian action in the Persian Gulf. Then Saudi Arabia reported a drone attack on oil facilities, which only intensified the pressure that would have normally pushed prices quite a bit higher.

However, this time there is the stable headwind of U.S. production and inventories. Yesterday’s API report served as the stabilizing force to keep prices relatively unchanged. U.S. production has been supported by the latest round of oil supply and demand forecasts that don’t expect global demand growth to be particularly lively this year.

To add to the downward pressure, Venezuela’s oil production surprisingly stabilized and even rose slightly last month, according to the latest Monthly Oil Market Report by OPEC released yesterday.

At the time of writing, Brent crude was trading at US$71.15 a barrel, with West Texas Intermediate at US$61.35 a barrel, both down slightly from opening.

By Irina Slav for Oilprice.com

https://oilprice.com/Energy/Energy-General/Bearish-EIA-Report-Keeps-Oil-Prices-Down.html

***

The IEA's Dire Warning For Energy Markets

Oil Price, May 14, 2019

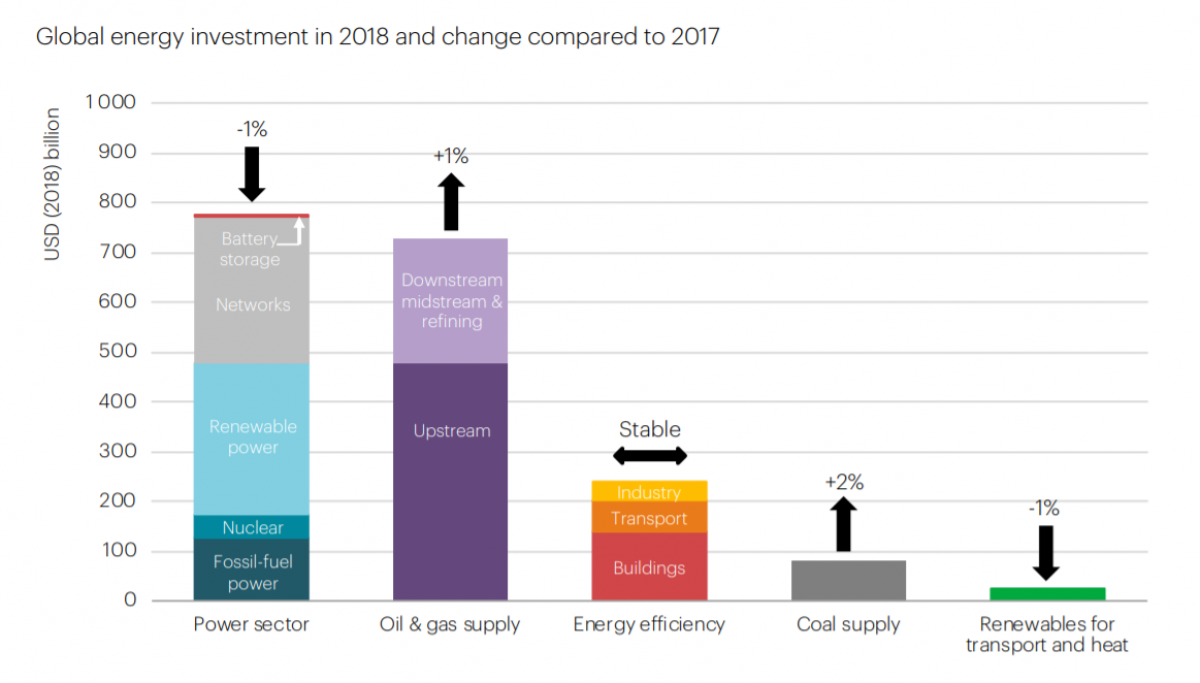

Global energy investment “stabilised” at just over $1.8 trillion in 2018, ending three years of declines.

Higher spending on oil, natural gas and coal was offset by declines in fossil fuel-based electricity generation and even a dip in renewable energy spending. China was the largest market for energy investment, even as the U.S. closed the gap.

After the 2014-2016 oil market bust, spending on oil and gas plunged, and only started to tick up last year. But the oil industry is not returning to its old spending ways. New investment is increasingly concentrated in short-cycle projects, namely, U.S. shale, “partly reflecting investor preferences for better managing capital at risk amid uncertainties over the future direction of the energy system,” the IEA wrote in its report.

Upstream spending rose by a modest 4 percent, which only partially repairs the savage cuts following the 2014 bust, which saw upstream spending fall by about 30 percent. However, the IEA said that 2019 could be a bit of a turning point, with a “new wave of conventional projects” in the works.

Despite the increase in spending on new oil projects, “today’s investment trends are misaligned with where the world appears to be heading,” the IEA said. “Notably, approvals of new conventional oil and gas projects fall short of what would be needed to meet continued robust demand growth.”

But in the next breath, the IEA warned that the world is on an unsustainable path in terms of carbon emissions. “There are few signs in the data of a major reallocation of capital required to bring investment in line with the Paris Agreement and other sustainable development goals,” the agency said. “Even as costs fall in some areas, investment activity in low-carbon supply and demand is stalling, in part due to insufficient policy focus to address persistent risks.”

These goals are at odds with each other – investing in new sources of oil and gas to ensure supply growth for years to come, while at the same time reallocating capital to renewable energy to accelerate an energy transition away from fossil fuels.

In fact, the IEA acknowledges as much. Despite oil and gas spending standing at a fraction of pre-2014 levels, the agency said that spending on fossil fuels “would need to taper further to be consistent with” the Paris Climate Agreement. “However, investment levels fall well short of what would be needed in a world of continued strong oil demand.”

In other words, on a business-as-usual trajectory, the world could find itself short on oil in the next decade absent a major increase in spending on developing new reserves. However, if there is any hope of reaching climate goals, spending on oil, gas and coal needs to fall. It’s largely a zero-sum equation, one that many governments have failed to reckon with.

It’s entirely conceivable that by 2030, clean energy accounts for 65 percent of total energy investment, up from 35 percent today, although it will require a “step-change in policy focus, new financing solutions at consumer and bulk power levels and faster technological progress,” the IEA said.

The good news is that costs continue to fall. Solar PV has seen costs decline by 75 percent since 2010, and onshore wind and battery storage costs are down by 20 percent and 50 percent, respectively. As such, a dollar spent on renewables buys a lot more energy than it used to, so flat investment is not entirely negative. And in a growing number of places, solar and wind are the cheapest option for power generation – increasingly cheaper than existing coal plants.

Geographically, investment is concentrated in rich countries. Roughly 90 percent of total energy investment – both for fossil fuels and for renewable energy – was funneled into high- and upper-middle income regions. Rich countries alone accounted for 40 percent of total energy investment, despite only making up 15 percent of the global population.

Those figures are flipped for lower-middle and poor countries – 40 percent of the population but only 15 percent of total energy investment. Even within those unequal figures, India dominates, which means that the rest of the Global South sees a vanishingly small percentage of energy investment. Because higher income countries simply have more aging assets to replace, the investment breakdown will likely continue at current figures, but the IEA warns that the makeup needs to “rebalance towards the fast-growing needs of lower-middle and low-income countries.”

https://oilprice.com/Energy/Energy-General/The-IEAs-Dire-Warning-For-Energy-Markets.html

***

Share the link of this article with your facebook friends

|

|

|

|

||

|

||||||